From 18th November 2025, Companies House is introducing mandatory identity verification for all company directors, People with Significant Control (PSCs), and anyone who files information on behalf of a company. It’s one of the most significant updates to UK company law for decades, forming part of a broader strategy to reduce corporate fraud, improve transparency and ensure that companies operating in the UK can be trusted.

For most legitimate businesses, the process should be simple. However, the changes are worth understanding properly — particularly if your organisation has historic directorships, international corporate structures, or if you work in sectors where fraud risk is higher.

At Reveal Private Investigations, we regularly assist businesses that have been affected by fraudulent company activity, undisclosed conflicts of interest, and internal misconduct. The new identity verification requirements are expected to reduce certain types of fraud, but they will not eliminate all of the risks businesses face.

Why Is Companies House Introducing Identity Verification?

The UK has traditionally had one of the easiest company formation systems in the world. A company could be incorporated online in minutes, and a director could be appointed simply by entering a name and address. No documents were required to prove that the person named was real, traceable, or even aware that they had been listed.

Because of this, people often assume that if a company appears on Companies House, and the director’s name matches the person they are speaking to, the business must be legitimate. In reality, the individual may never have been verified at any point in the company’s existence. This has allowed “ghost directors”, stolen identities, shell companies and fraudulent trading networks to operate with very little accountability.

The new identity verification system is intended to close that gap, ensuring that individuals named as company directors or persons of control are real, identifiable and reachable, and that they can be held responsible for the companies they run.

Who Needs to Verify Their Identity?

Anyone acting as a company director, a person with significant control, a member of an LLP, or someone who files information on behalf of a company will be required to verify their identity. Both existing and newly appointed directors will need to complete verification. This is not optional — failing to verify will eventually mean that the individual is no longer legally permitted to act in that role.

How Will Identity Verification Work?

Identity verification will take place either directly through Companies House or through an authorised agent, such as an accountant or company formation agent. Verification will be primarily digital, using document upload and biometric matching (such as comparing a live photo to a passport), although non-digital routes will be available where needed.

Once verified, an individual does not need to repeat the process for each company they are associated with.

Feel Your Business is a Victim of Fraud?

Frequently Asked Questions About The Companies House Identity Verification Process

What types of document can be used to verify indentity to Companies House?

Commonly accepted forms of ID are expected to include passports, driving licences and national identity cards.

More detail can be found here.

How long do I have to verify my identity to Companies House?

New directors will be required to verify before they can act. Existing directors will be given until their next confirmation statement is due, this means theoretically the latest possible date could be to 17th November 2026.

What happens if a director does not verify their identity?

A director who fails to verify will not legally be able to act as a director. They will not be able to approve filings, sign documents. Technically they can no longer participate in company decision-making although that would be difficult to enforce as it is generally be done internally.

What happens to a business if it continues to list unverified directors?

A company that continues to list unverified directors may find that filings are blocked, the company is flagged as non-compliant, and enforcement or financial penalties may follow. In more serious cases, Companies House may refer the matter for criminal investigation.

How long is the transition period for existing directors?

The length of the transition period will depend on when the companies next confirmation statement is due, existing directors will need to complete verification within that timeframe to avoid non-compliance.

Do I have to verify my directors identity online?

Online verification will be the primary route. However, the government recognises that not everyone is able to verify digitally, so alternative methods will be offered, this will likely involve verifying physical documents in a post office.

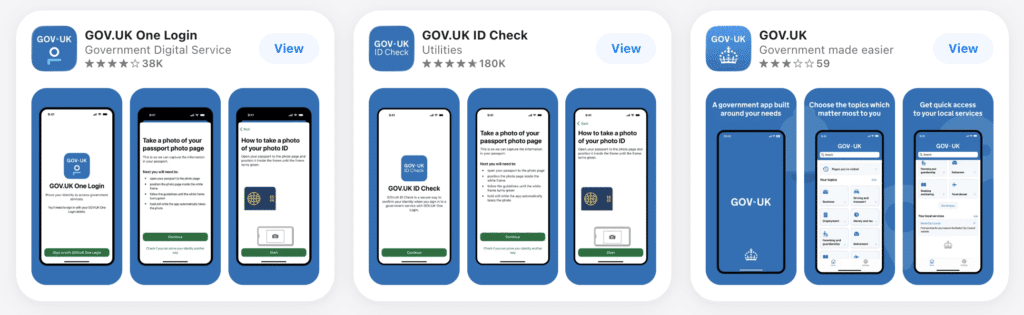

How do I verify my directors identity through the Gov.UK App?

The easiest way to very a directors identity is to use the Gov.UK app but despite the governments best efforts to make this a simple and straight forward process, there are actually three Gov.UK mobile apps. The Gov.UK, the Gov.UK One Login App and the Gov.UK ID Check App, it is the One Login app you need to use (not the ID check app 🤷♂️).

Identity Verification Helps — But It Doesn’t Eliminate All Business Fraud

These reforms should significantly reduce the number of businesses being used purely as fronts, and make it much harder for individuals to hide behind false or untraceable identities. However, the majority of fraud that affects everyday businesses happens internally, not through fake companies.

We frequently support organisations experiencing issues such as the personal use of company assets to complete jobs “off the books” and the disclosure of tender information to secure contracts. In other cases, businesses encounter employee misconduct, false or exaggerated sickness and workplace injury claims, particularly in labour-intensive sectors where physical work is involved.

These are the types of issues that identity verification alone won’t prevent — they require internal controls, awareness, and when needed, discreet investigation.

How Can Private Investigators help with Business Fraud or Employee Misconduct?

Businesses often begin to notice small signals before a problem becomes clear: unexplained expenses, unusual patterns in workload or hours, clients mentioning work being completed privately, or inconsistencies in injury reporting. These issues can be sensitive, and they need to be handled carefully to protect both the business and the individuals involved.

In cases like these, having independent, evidence-based clarity is far more valuable than acting on assumption or suspicion. Our role is to help businesses understand what is happening so they can make informed, fair decisions.

The introduction of Companies House identity verification is a positive step toward a more transparent and accountable business environment in the UK. It should reduce fraudulent company formations and make it easier to establish trust when working with new partners or clients. However, it is not a complete solution to corporate fraud — and internal misconduct remains a significant risk area for many organisations.

If you would like to discuss how these changes may affect your business, or if you have concerns about fraud or integrity within your organisation, we are always open to a confidential conversation.

Surveillance

Surveillance Matrimonial Investigations

Matrimonial Investigations Bug Sweeping

Bug Sweeping GPS Vehicle Tracking

GPS Vehicle Tracking Lie Detector Test

Lie Detector Test Person Tracing

Person Tracing Employee Investigations

Employee Investigations Asset Tracing

Asset Tracing Fraud Investigations

Fraud Investigations Injury & Insurance Investigations

Injury & Insurance Investigations